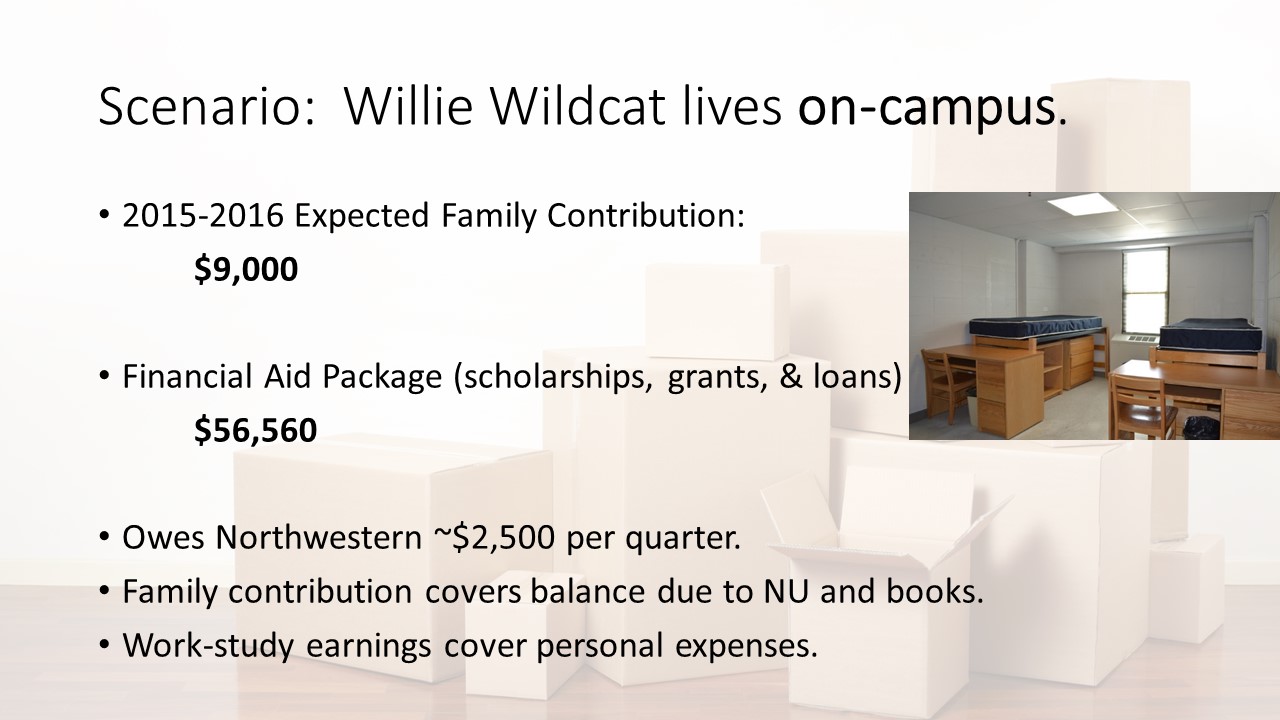

Living Off-Campus: Scenario 1

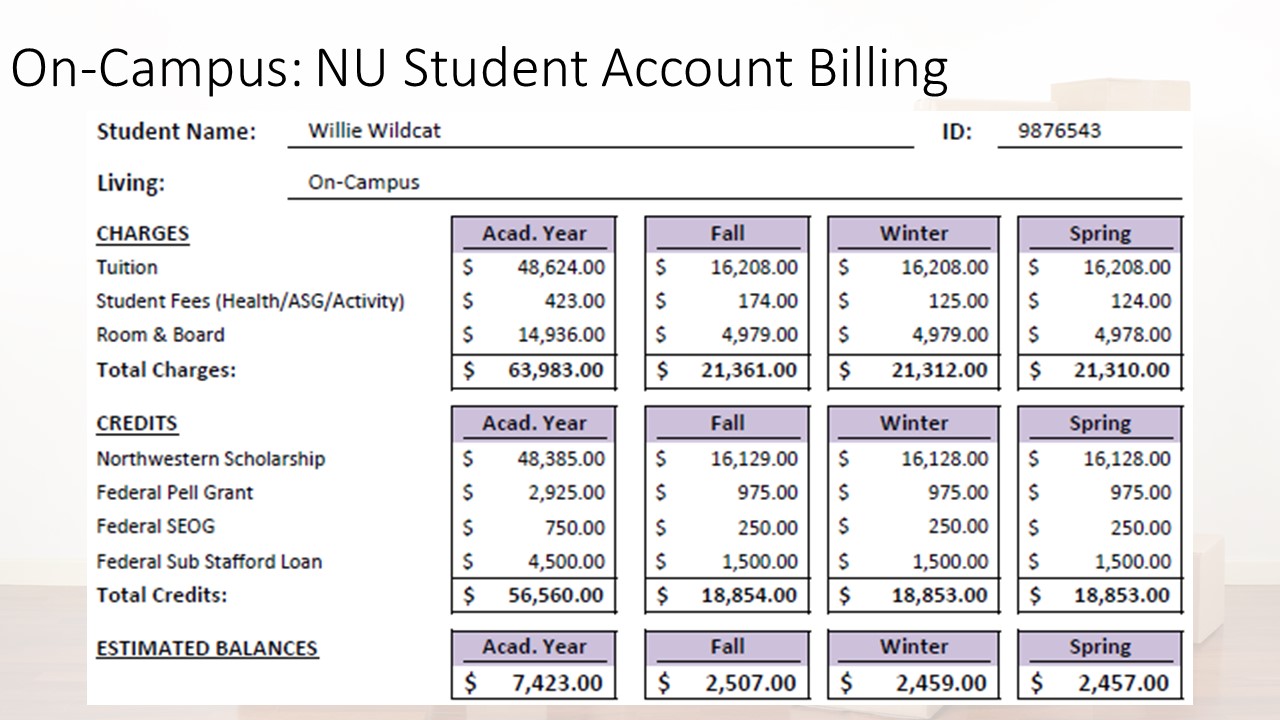

This student lives on-campus this year in a double room. After his financial aid applies to his account, he owes Northwestern about $2,500 per quarter, and his family contribution covers that balance and his books. He also has a work-study job to help with his other living expenses, such as toiletries and personal spending.

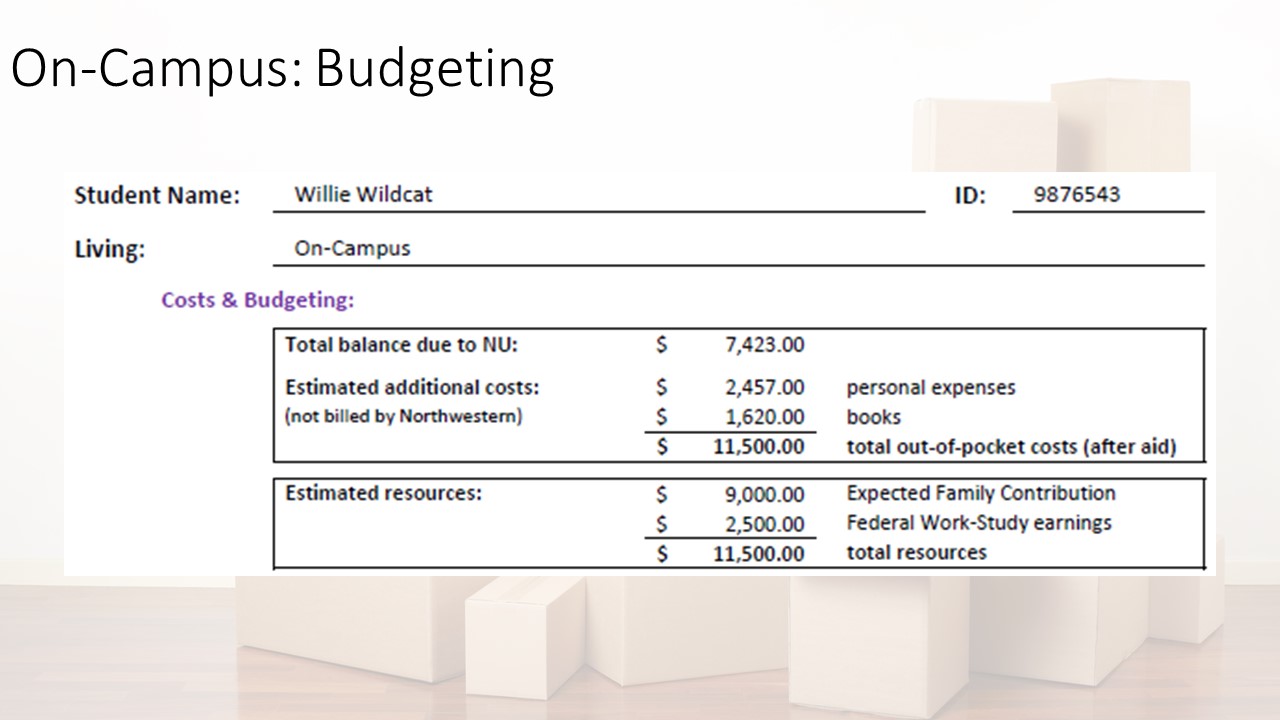

The first step in building a budget is to figure out what your expenses are, and then determine how you’ll cover them.

In addition to his NU bill, Willie also has to buy books and cover his other living expenses every quarter, so his total costs for the year are $11,500. His family contributes $9,000, and he earns $2,500 at his work-study job. The total expenses he has to cover and his expected resources to pay for them match up.

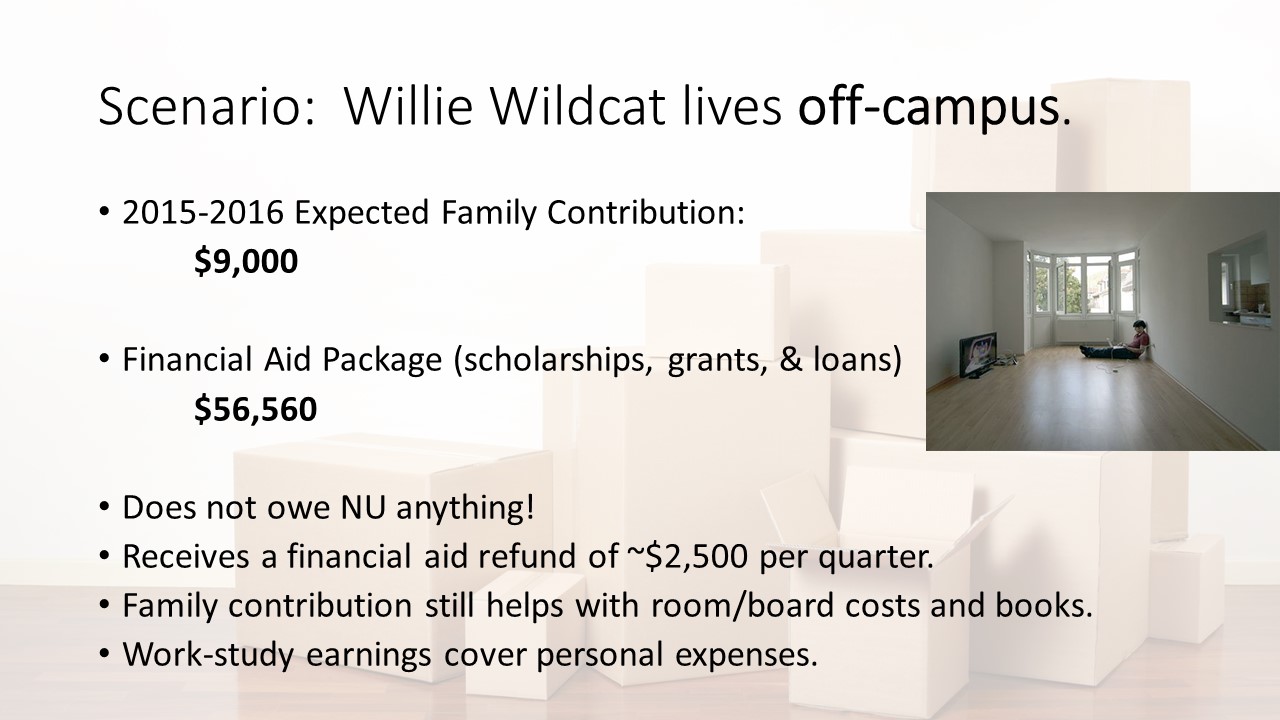

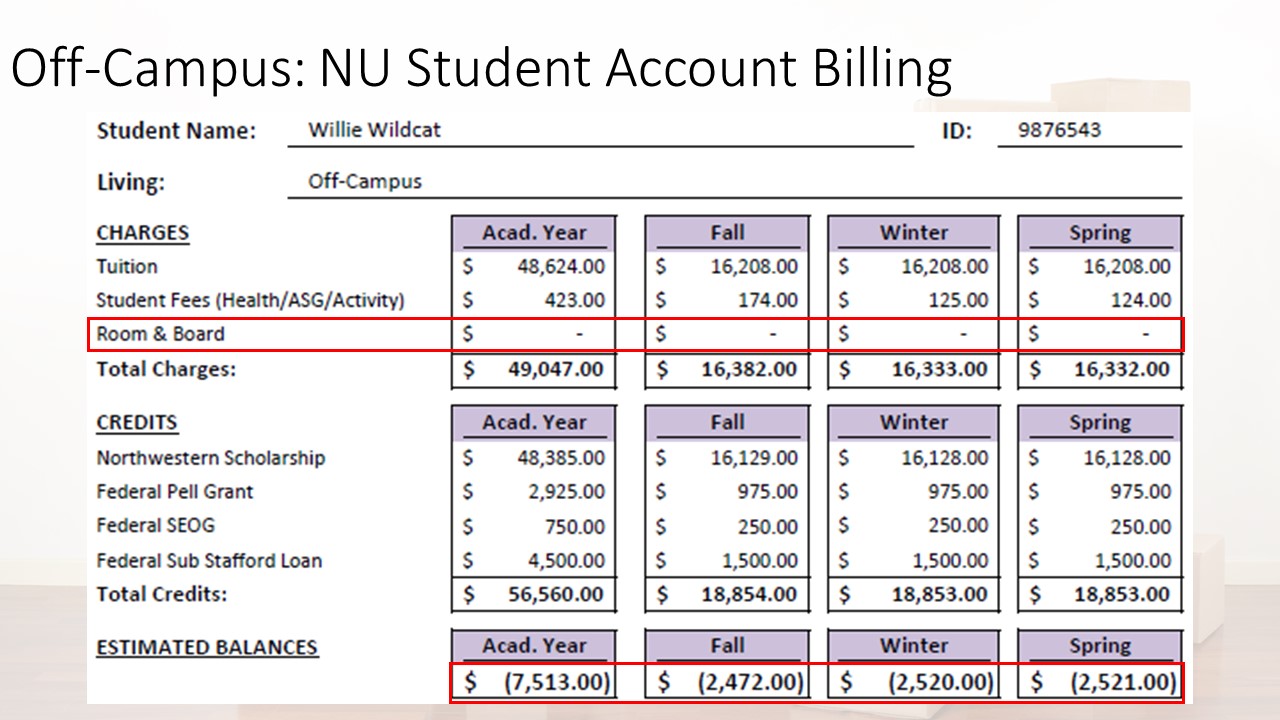

If he moved off-campus, Willie’s family contribution and financial aid would be exactly the same, but he would not be billed for room and board. Since his financial aid completely covers his tuition and fees, he won’t owe Northwestern anything each quarter.

Since his financial aid also helped to cover his room and board charges, Willie is eligible for a financial aid refund – he’ll actually get back some of his aid every quarter to help him pay his off-campus bills.

That doesn’t mean his family contribution goes away – it just means that instead of sending money to Northwestern every quarter, his family will help him pay his rent instead.

Willie still has to pay for his books and personal expenses each quarter, and he also has to budget for his off-campus expenses. His financial aid refunds will help, and then his family contribution and work-study job still cover the rest. If he budgets carefully, his total costs and total resources still match.