Living Off-Campus: Budgeting

This year, your financial aid was based on a budget of $4,979 per quarter. Plan on a similar budget for next year, and don’t forget about the off-campus costs you don’t currently have to worry about in the dorms.

What does a quarterly budget actually look like living in an Evanston apartment? Can you really save money living off-campus? It really depends on you. But you have to plan a budget! Let’s look at some examples:

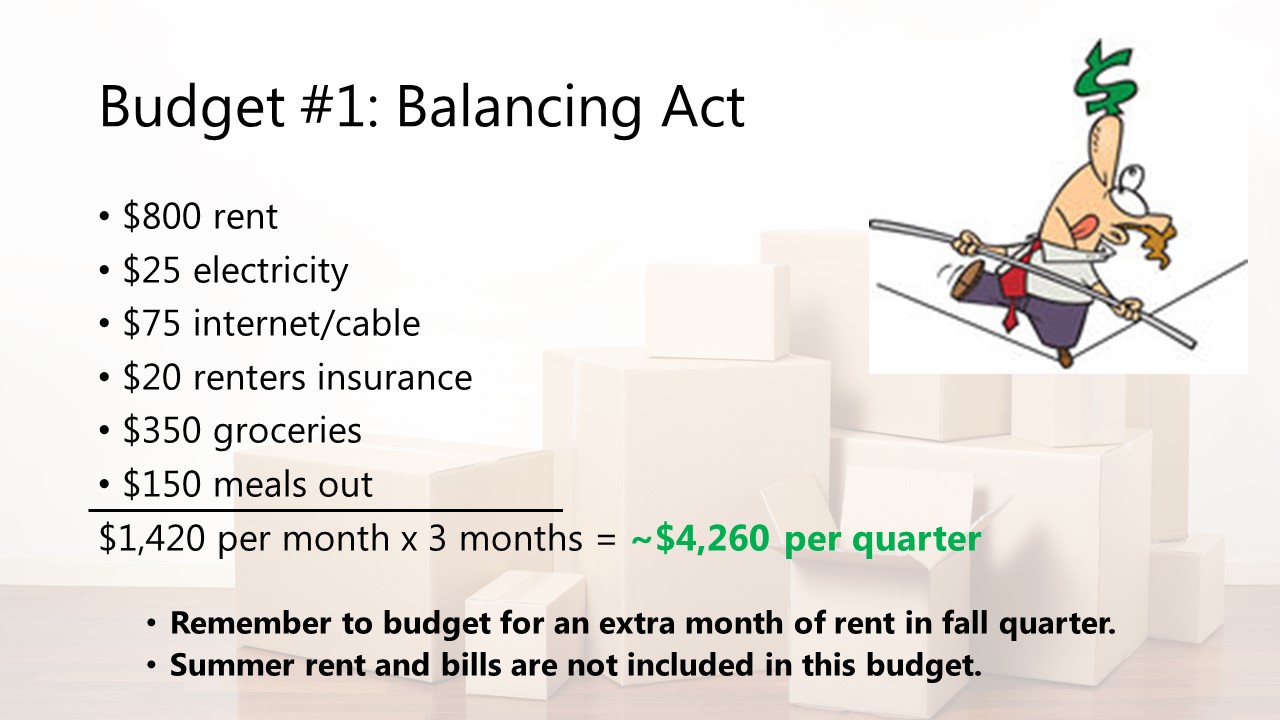

Budgeting can feel like walking a tightrope: You have to figure out what all your expenses, and you have to plan how you will pay for them. In a successful budget, your total expenses should never be greater than your total resources.

This person has balanced his budget pretty effectively. He has his rent and his bills covered, he primarily buys groceries and makes his meals at home, and he’s pretty reasonable about eating out every month. His total expenses come in at just under $4,300 a quarter, so he’s within his budget and has a little wiggle room. Remember that he also has to pay for a fourth month of rent in the fall if he didn’t already pay it when he signed his lease – this wiggle room might help him to do that, or he can put some money aside for his summer rent.

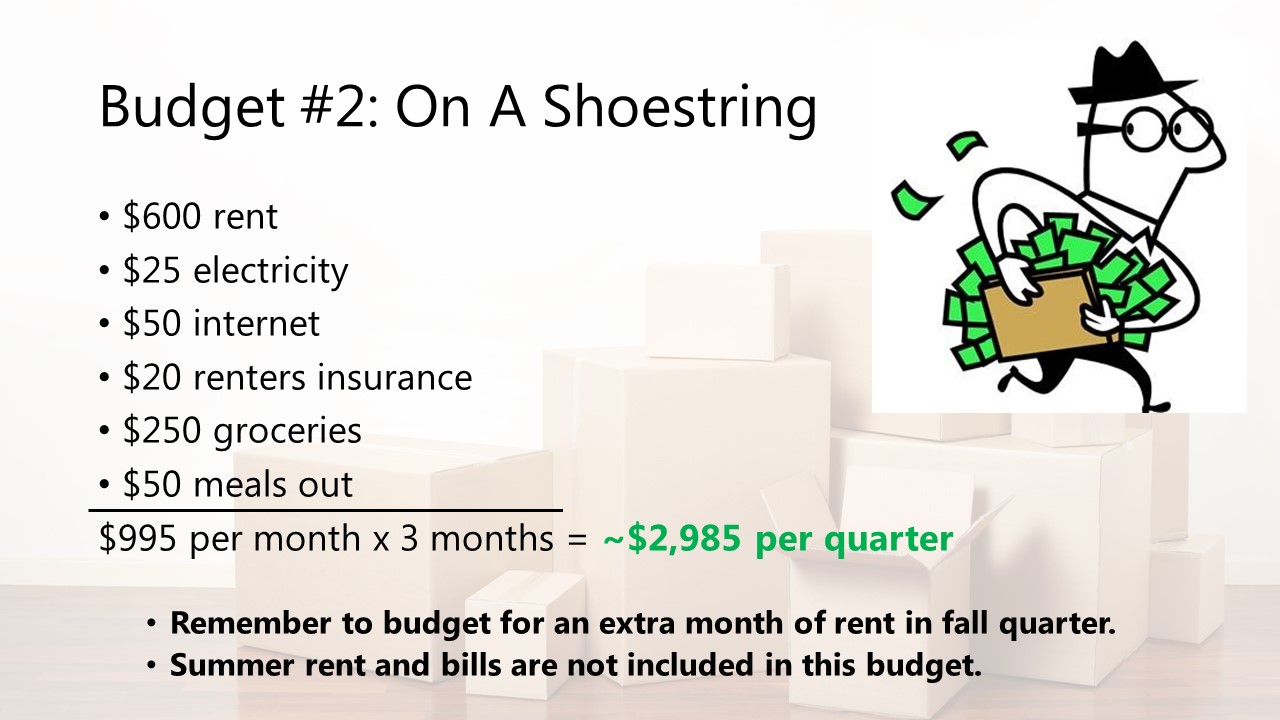

When you live on your own, it is possible to save money if you really rein in your spending off-campus. For example, if you and your roommate split a $1,200 apartment, have internet but not cable, and you grocery shop more than eat out, you’d be amazed at how much cheaper that ends up being.

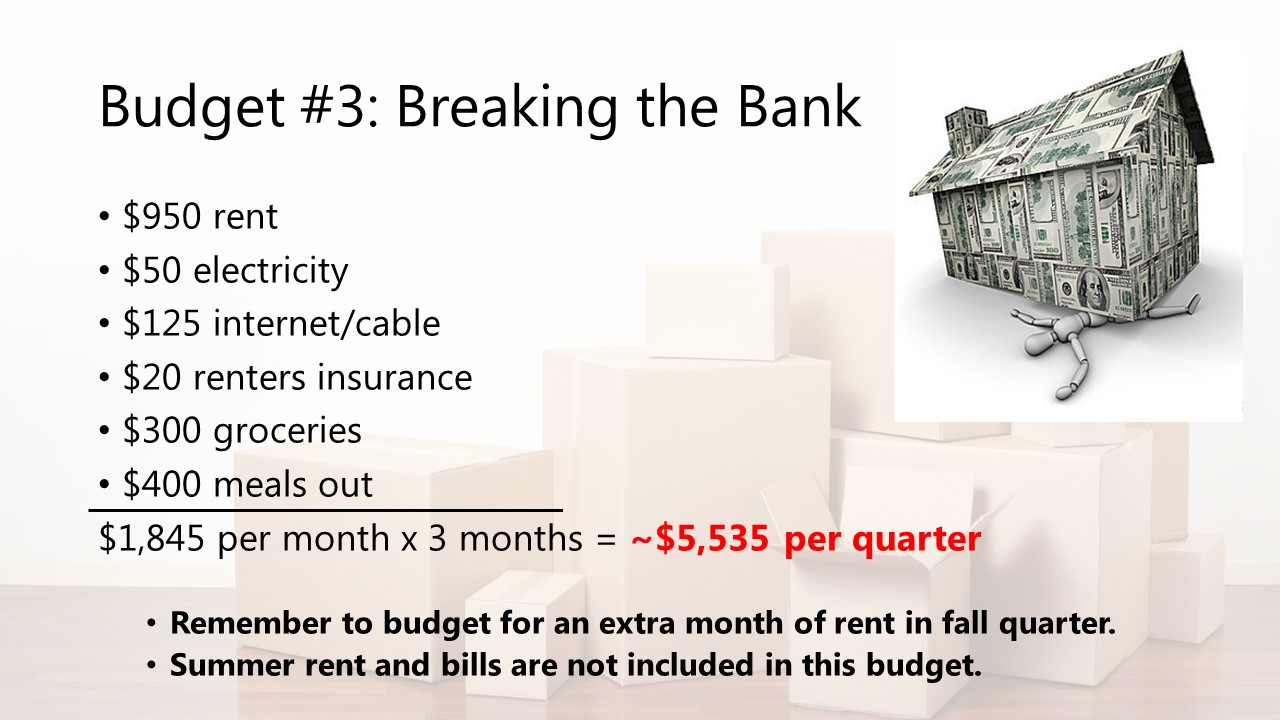

On the other end of the spectrum, if you don’t budget carefully, you might find yourself coming up a little short. You want to avoid over-spending when you live off-campus, because your aid can’t be increased if you live outside your means. If you do request your whole financial aid refund at the beginning of the quarter, make sure it lasts!